Two and half years ago the Liberals set a target for cutting car insurance costs. They missed it, but urge patience, saying more is on the way.

ANDREW FRANCIS WALLACE / TORONTO STAR Order this photo

Premier Kathleen Wynne has admitted that she thought it would be a stretch to meet the 2013 promise of reducing car insurance by 15 per cent. Her Finance Minister Charles Sousa says he's still trying to push rates down.

Back in 2013, when Ontario’s wobbly Liberal minority government promised to cut car insurance by 15 per cent within two years, the province’s 8.5 million drivers sat up and took note.

Finally, the prospect of relief from the highest car insurance costs in Canada. In the GTA, according to the Insurance Bureau of Canada, they are the highest of the high, at about $1,600 per car, around double what it costs in Quebec and the Maritimes.

Such a cut would come to $240 off the annual bill per GTA car. It was such a popular issue, the pledge became part of the Liberal’s re-election campaign. Who knows, maybe it helped propel them to a majority in June, 2014.

But a year and a half later, the car insurance file has sputtered. The Liberals get credit for reaching half that target, about 7 per cent. But the premier said in off-the-cuff remarks a week ago that hitting the full 15 per cent was always going to be “a stretch goal.”

When finance minister Charles Sousa was asked about the boss’s comment on the way into a cabinet meeting Monday, he avoided answering.

Sousa admitted that meeting the target has been a challenge, but he will continue to work to push rates down. No firm date or amount was offered. Part of the problem, he said, was the election that gave the Liberals their majority. The campaign and dissolution of the legislature delayed the introduction of a bill to tackle high insurance costs. That in turn has delayed the benefits for drivers.

The legislation, since passed, is a step in the right direction. It includes such things as speeding up the process to settle disputed accident claims. It limits the amounts that auto body shops can bill insurers to store vehicles under repair. It also included licensing and more oversight of clinics that offer rehab services. The insurance regulator, Financial Services Commission of Ontario (FSCO), gets more power to prosecute fraud.

So when can we expect more?

“It’s not at any one point or one date that matters to me, it’s the ongoing ability to reduce the cost of claims to further reduce our insurance premiums,” Sousa said Monday. The message: a hard target is no longer in the cards, but we should believe the pressure is still on.

There wasn’t much evidence of that in FSCO’s review of car insurance applications during the last three months of 2015. Provincial rates fell an average 0.15 per cent. On the $1,600 GTA policy, that’s an annual saving of $2.40.

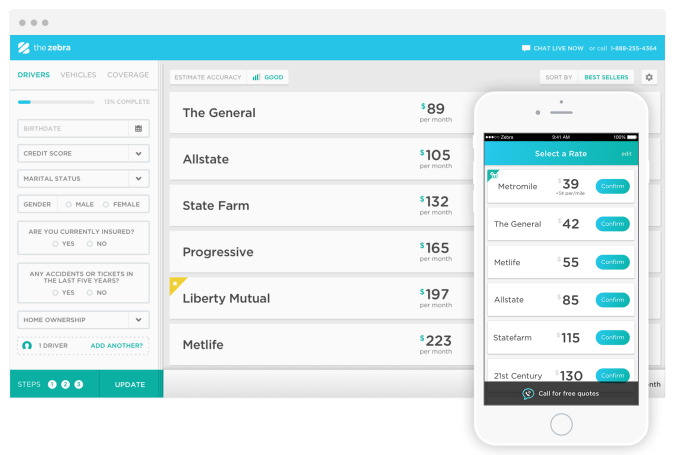

Sousa’s most helpful comment in the scrum was to note that with 110 companies selling car insurance in Ontario, there’s a lot of choice. “We encourage people to shop around,” he said.

Have your say

Has your car insurance dropped over the past few years?

NoYesNot sure

VoteView Results

He’s right. Here’s what you can add to that when you’re looking for auto insurance:

Never accept the renewal at face value. Call your insurer and go over the policy. Use the Internet to visit web sites that compare insurance rates.

Don’t assume that companies charge the same price for similar policies. The price is based on loan losses in your area. Since each company has a different claims experience, rates vary from one company to the next.

If you use an insurance broker, don’t assume the broker will find the best rate from all the companies in Ontario. Brokers typically represent half a dozen or so companies. What you’re getting is the best of their bunch.

The jury is out on the Liberal car insurance pledge. They missed a target, but they did do something. The word is that the quarter ending March 31 will see a significant resumption in the decline of car insurance.

I hope so, because otherwise, no matter how the government frames this — as a stretch or a target or a pledge or a broad commitment — it will show they’ve given up. It was, in plain English, a promise. And that should be binding.

Adam Mayers writes about investing and personal finance on Tuesdays and Thursdays. Have a question? Reach him at amayers@thestar.ca

5 ways to cut insurance costs

Check for group discounts through your employer, union, professional or alumni association.

Bundle as many policies as you can — home, car, recreational vehicles, vacation homes.

Check out anti-theft devices. Ask your insurer which ones it endorses.

Consider higher deductibles and less coverage.

The new winter tire discount may knock 5 per cent off your renewal.